Venmovenmo | payment | bank |

||||

| Category Apps | Finance |

Developer PayPal, Inc. |

Downloads 10,000,000+ |

Rating 4.2 |

|

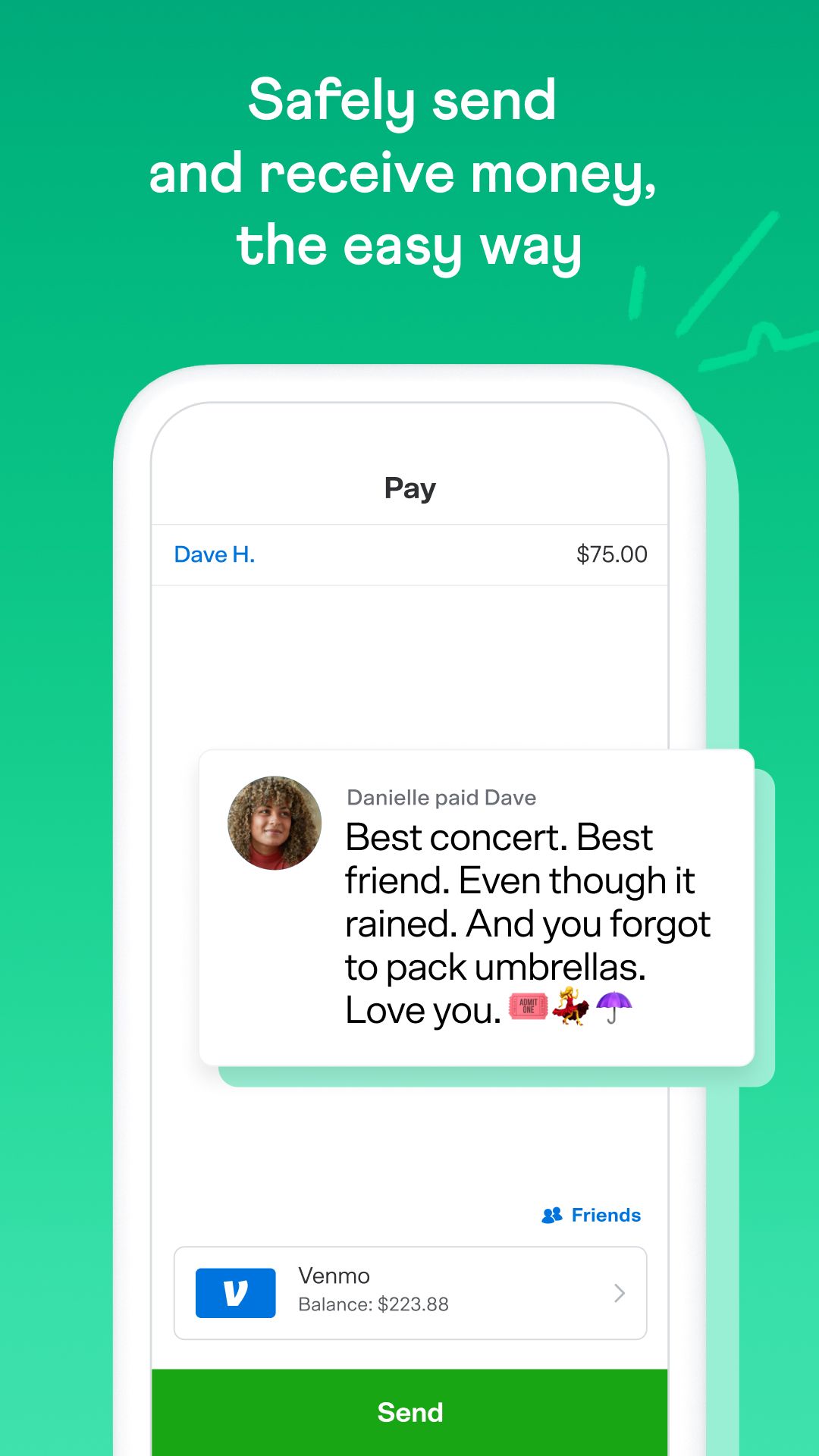

Welcome to the world of Venmo, the app that revolutionizes the way we handle payments and money transfers. With Venmo, sending and receiving money has never been easier. Whether you’re splitting a bill with friends, paying for goods and services, or simply sending money to family, Venmo provides a convenient and seamless platform to manage your finances. Let’s explore the features and benefits that make Venmo a popular choice for millions of users worldwide.

⚠️ BUT WAIT! 83% of Users Skip This 2-Min Guide & Regret Later.

Features & Benefits

- Easy Money Transfers: Venmo allows you to send money to friends, family, or businesses with just a few taps on your smartphone. Simply link your bank account or credit/debit card to your Venmo account, and you can effortlessly transfer funds to anyone in your contact list. No more hassle of writing checks or dealing with cash.

- Splitting Bills Made Simple: Splitting bills with friends has never been easier. Whether you’re dining out, shopping, or organizing an event, Venmo lets you split expenses among multiple people. With just a few clicks, you can divide the bill and send payment requests to your friends, ensuring a fair and hassle-free process.

- Venmo Card: The Venmo Card is a physical debit card linked to your Venmo account. It allows you to make purchases at any location that accepts Mastercard, both online and offline. The card offers cashback rewards on select purchases, adding an extra benefit for frequent users.

- Social Integration: Venmo incorporates a social aspect, allowing users to share and engage with their transactions. This feature adds a fun and interactive element, with users having the option to add emojis, comments, and even customize transaction descriptions. It creates a sense of community among users and fosters a more engaging payment experience.

- Security and Fraud Protection: Venmo prioritizes security and offers fraud protection for its users. The app utilizes encryption and secure protocols to protect sensitive information. Additionally, Venmo monitors and detects suspicious transactions, providing an added layer of security for its users.

Pros & Cons

Venmo Faqs

Venmo employs several security measures to safeguard user accounts. The app utilizes encryption to protect transaction data during transmission. Additionally, it offers two-factor authentication, which adds an extra layer of security by requiring a verification code sent to your registered phone number or email when logging in from a new device. Users can also enable a PIN code or biometric login (fingerprint or facial recognition) for easier access while maintaining security. If you encounter a dispute or believe there has been an unauthorized transaction, you can report the issue directly through the app. Venmo allows users to notify them of any discrepancies within their account under the “Transaction” section. The support team will investigate the matter, and if unauthorized activity is confirmed, they may reimburse you. It’s essential to file these reports promptly and to check your account regularly for any unfamiliar transactions. Yes, Venmo offers a separate service called Venmo for Business, which allows merchants to accept payments through the app. Businesses can create a Venmo profile and receive payments from customers who wish to pay using their Venmo balance, linked bank accounts, or credit/debit cards. It is crucial for businesses to understand that there are specific fees associated with receiving payments through this service, typically around 1.9% + $0.10 per transaction. Yes, Venmo imposes limits on both sending and receiving funds. Initially, new users have a weekly sending limit of $299.99. This increases to $4,999.99 after verifying your identity, which involves linking your bank account and providing personal information. For receiving, there is no set limit; however, your Venmo balance can hold up to $3,000 at any given time, after which you will need to transfer funds to your bank. Venmo transactions default to a social feed that shows your activity to friends and the public. However, you can manage this setting by going to ¡°Settings¡± > ¡°Privacy.¡± Here, you can choose to keep your transactions visible only to yourself, your friends, or everyone on the platform. You can also adjust privacy settings for each transaction before confirming payment or request. If you mistakenly send money to the wrong person, you cannot cancel the payment once it’s completed. However, you can request the recipient to return the funds. In cases where the recipient does not respond or refuses to return the money, you may consider reporting the issue to Venmo¡¯s customer support. They might not be able to recover the funds, but they’ll guide you on potential options available.What security features does Venmo offer to protect users’ accounts?

How does Venmo handle disputes or unauthorized transactions?

Can I use Venmo for business transactions?

Is there a limit on how much money I can send or receive through Venmo?

How do I make my transactions private or public on Venmo?

What happens if I accidentally send money to the wrong person?

Alternative Apps

- PayPal: PayPal is one of the leading payment platforms globally and offers similar features to Venmo. It allows users to send and receive money, make online purchases, and split bills. PayPal also provides a range of security measures and is widely accepted by businesses worldwide.

- Cash App: Cash App, developed by Square, is another popular payment app that enables users to send and receive money, make purchases, and invest in stocks and Bitcoin. It offers a user-friendly interface and provides a Cash Card for making purchases.

- Zelle: Zelle is a peer-to-peer payment service integrated with major banks in the United States. It allows users to send money directly from their bank accounts, making it a convenient option for seamless transactions between individuals. Zelle emphasizes speed and security, aiming to provide instant and secure money transfers.

These three apps, like Venmo, provide convenient and secure ways to handle payments and money transfers. Each app has its unique features and benefits, catering to a wide range of user preferences. Whether you’re looking for social integration, investment options, or seamless bank transfers, these apps offer alternatives to Venmo in the digital payment landscape.

Screenshots

|

|

|

|