Walletwallet | finances | budgeting |

||||

| Category Apps | Finance |

Developer BudgetBakers.com |

Downloads 5,000,000+ |

Rating 4.5 |

|

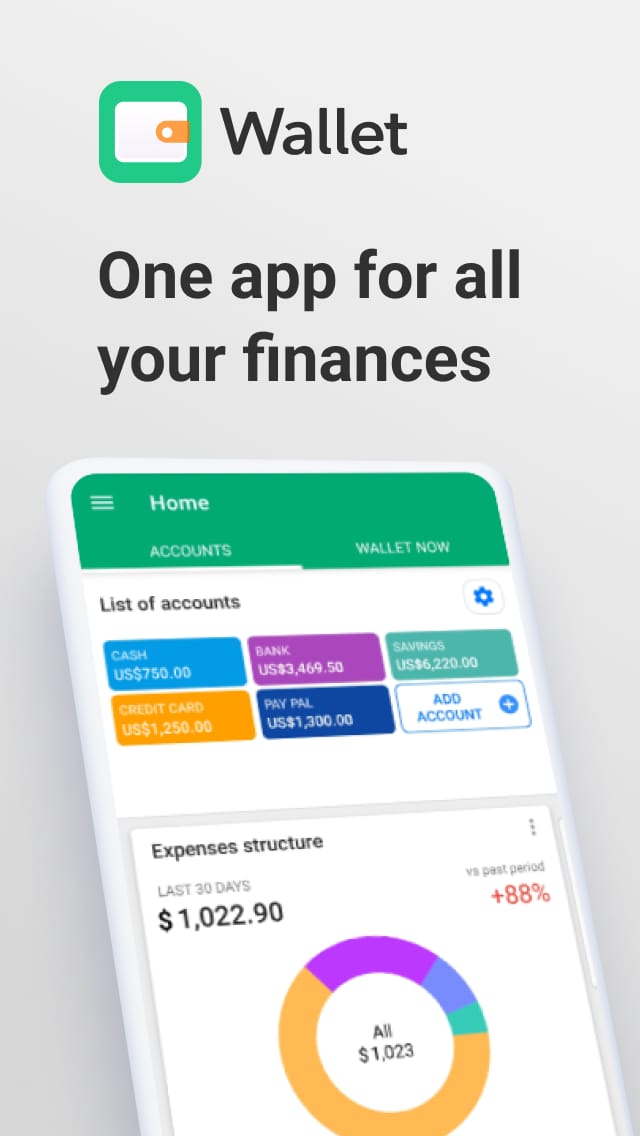

The Wallet App is a versatile mobile application designed to simplify and streamline personal finance management. With the Wallet App, users can track their expenses, create budgets, manage multiple accounts, and gain valuable insights into their financial habits. This app aims to provide users with a comprehensive tool to stay organized and make informed decisions about their money.

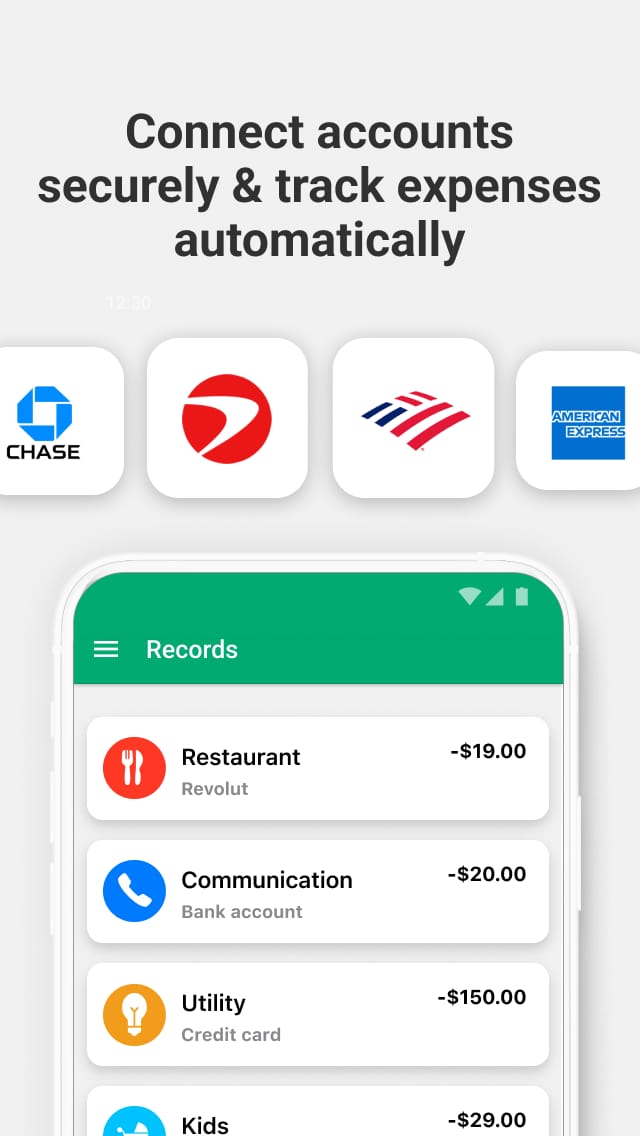

By linking their bank accounts and credit cards to the Wallet App, users can effortlessly track their transactions and categorize their expenses. The app also offers features such as bill reminders, goal setting, and spending analysis, empowering users to take control of their financial well-being.

⚠️ BUT WAIT! 83% of Users Skip This 2-Min Guide & Regret Later.

Features & Benefits

- Expense Tracking: The Wallet App allows users to effortlessly track their expenses by automatically importing transactions from linked bank accounts and credit cards. Users can categorize their expenses, add notes, and even attach receipts for a complete overview of their spending habits. This feature enables users to gain a clear understanding of where their money is going and identify areas where they can make adjustments.

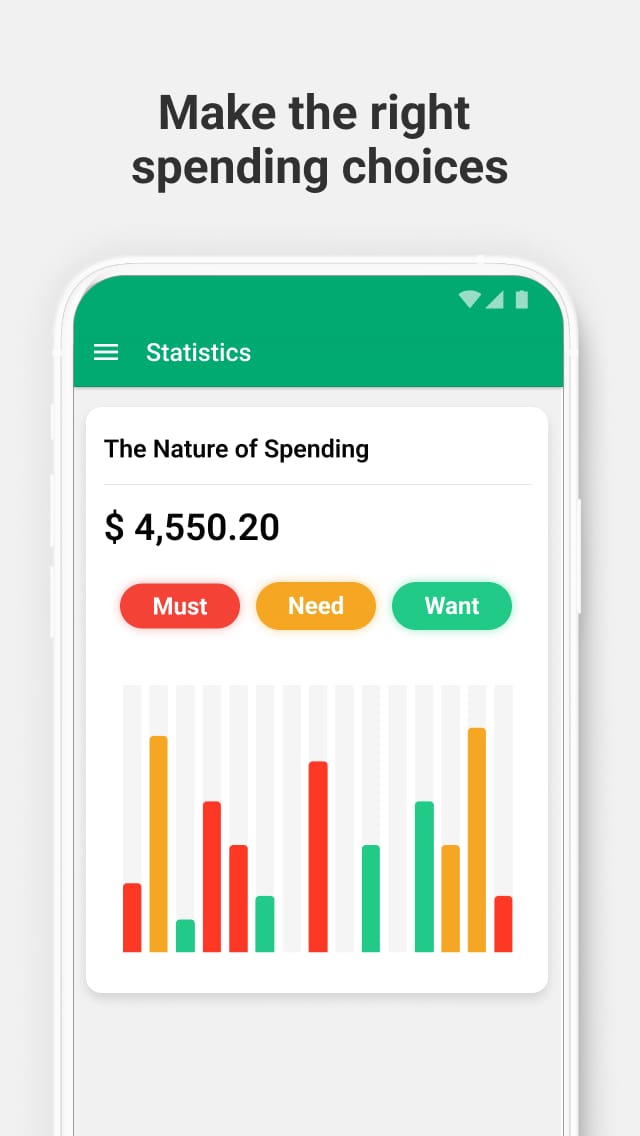

- Budget Creation and Management: With the Wallet App, users can create personalized budgets based on their income and financial goals. The app provides tools to set spending limits for different categories, track progress, and receive notifications when approaching budget thresholds. This feature helps users stay on track with their financial goals and make informed decisions about their spending.

- Account Aggregation: The app supports the aggregation of multiple accounts, including bank accounts, credit cards, and digital wallets. This allows users to have a centralized view of their financial status, with real-time updates on balances and transactions. By having all their accounts in one place, users can easily manage their finances and monitor their overall financial health.

- Bill Reminders: The Wallet App includes a bill reminder feature that sends notifications to users to ensure they never miss a payment. Users can set up recurring reminders for bills and receive alerts before the due dates. This feature helps users avoid late fees, maintain a good credit score, and stay organized with their financial obligations.

- Spending Analysis and Insights: The app provides comprehensive spending analysis tools that offer valuable insights into users’ financial habits. Users can visualize their spending patterns through charts and graphs, identify trends, and understand their expenses on a deeper level. This feature enables users to make more informed decisions about their spending and identify areas where they can save money.

Pros & Cons

Wallet Faqs

You can add a variety of payment methods to your Wallet app, including credit and debit cards from major banks, digital wallets, loyalty cards, and gift cards. To add a card, simply navigate to the “Add Payment Method” section, select your bank, and follow the prompts to enter your card details securely. Note that some financial institutions may require additional verification for security purposes. To set a default payment method, open the Wallet app and go to the settings or preferences section. Select the payment method you wish to make default and look for an option labeled “Set as Default.” Once selected, this will ensure that any payments made using the Wallet app will automatically use this method unless you choose another one at the time of transaction. Yes, the Wallet app can be used for online purchases at participating retailers and service providers. When checking out, look for the option to pay with your Wallet app. You may need to authenticate your identity using Face ID, Touch ID, or a passcode, depending on your device settings. Ensure that your payment methods are up-to-date for a seamless experience. Storing your credit card information in the Wallet app is generally considered safe due to advanced security features such as encryption and tokenization. The app does not store your actual card numbers but rather creates a unique identifier for transactions. Additionally, enabling biometric authentication adds an extra layer of protection to your sensitive data. The Wallet app offers features to help track your spending by categorizing transactions linked to your payment methods. Navigate to the “Transactions” or “Activity” section to view a detailed history of your expenditures. Some apps also provide analytics tools to visualize your spending habits over days, weeks, or months, allowing you to manage your finances more effectively. Currently, most Wallet apps do not support direct sharing of balance or funds between users. However, you can send money to others if the app supports peer-to-peer payment features. This typically involves entering the recipient¡¯s email address or phone number and confirming the transfer amount. Always ensure that you’re sending money to verified contacts for safety. If you lose your phone, immediately take action to protect your data by accessing the remote wipe feature available through your phone’s security settings (if enabled). You should also contact your bank or the issuers of your stored cards to report the loss and deactivate those cards. Many Wallet apps have built-in features to lock your account or suspend transactions if unauthorized access is suspected. Updating your payment information can be done easily within the Wallet app. Go to the “Payment Methods” section, select the card you wish to update, and look for options to edit the card details. Here, you can modify your billing address or expiration date. If you need to remove a card, select the card and look for the “Remove” option. Always ensure your information is accurate to avoid payment issues.What types of payment methods can I add to my Wallet app?

How do I set a default payment method in the Wallet app?

Can I use the Wallet app for online purchases?

Is it safe to store my credit card information in the Wallet app?

How do I track my spending in the Wallet app?

Can I share my Wallet app balance with someone else?

What should I do if I lose my phone with the Wallet app installed?

How can I update my payment information in the Wallet app?

Alternative Apps

- Mint: Mint is a popular personal finance app that offers similar features to the Wallet App. It allows users to track expenses, create budgets, and receive bill reminders. Mint also provides credit score monitoring and personalized financial recommendations.

- YNAB (You Need a Budget): YNAB is a budgeting app that focuses on helping users gain control of their finances. It emphasizes the concept of giving every dollar a job and provides tools to create and manage budgets effectively. YNAB also offers educational resources and live workshops to help users improve their financial literacy.

- PocketGuard: PocketGuard is a budgeting app that focuses on helping users save money and achieve their financial goals. It tracks expenses, creates budgets, and provides insights into users’ spending habits. PocketGuard also offers features like bill tracking and subscription management to help users stay on top of their financial obligations.

These apps, like the Wallet App, aim to simplify personal finance management and empower users to make better financial decisions. Depending on individual preferences and specific needs, users can explore these alternatives to find the app that best aligns with their goals and preferences.

Screenshots

|

|

|

|